The Agency Relationship in Corporate Finance Occurs

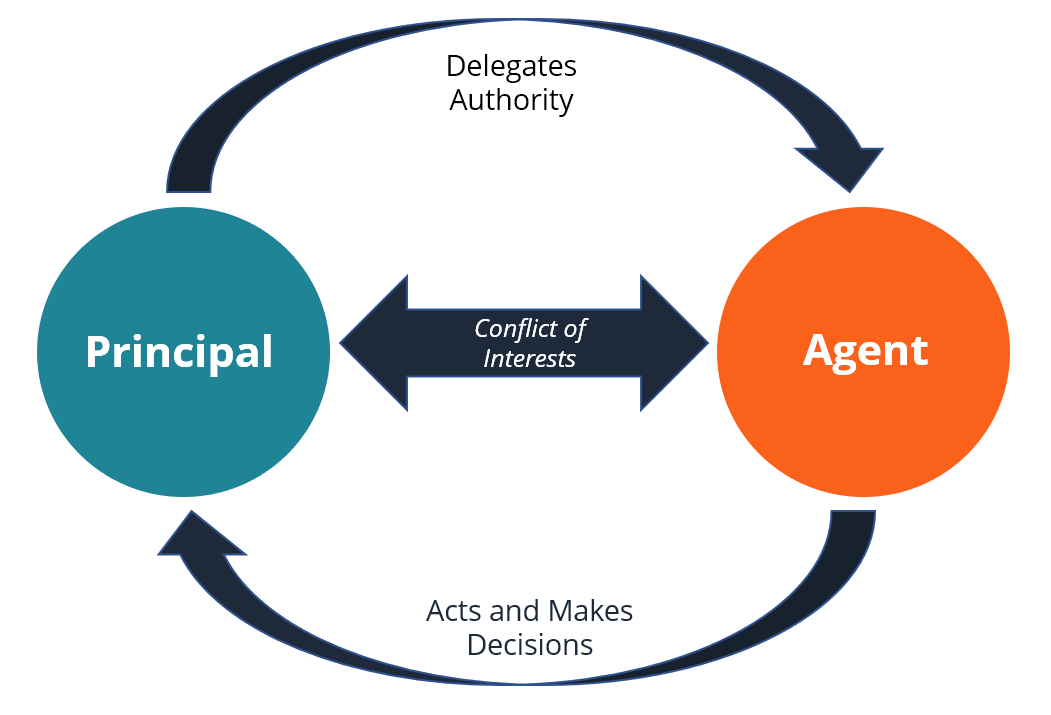

The agent is expected to act in the best interest of the principal. When the board of directors oversee the CEO.

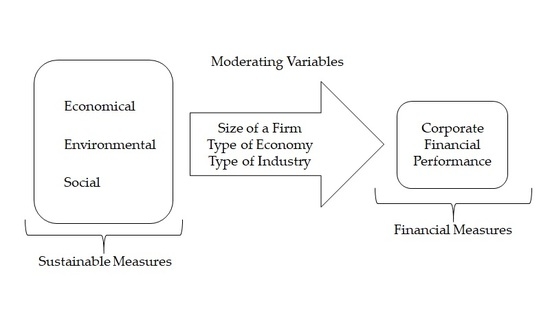

Sustainability Free Full Text The Impact Of Sustainability Practices On Corporate Financial Performance Literature Trends And Future Research Potential Html

They establish a system of control and conduct where one party gives up.

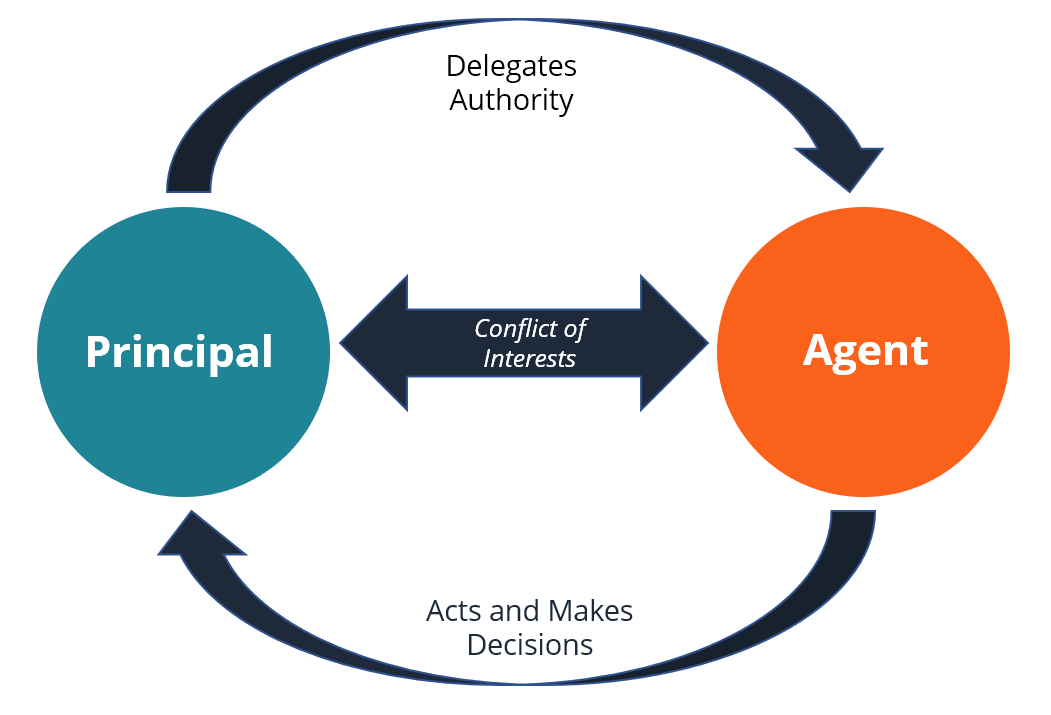

. The agency relationship allows the agent to work on behalf of the principal as if the principal was present and acting alone. The term Principal-agent relationship or just simply Agency relationship is used to describe an arrangement where one entity the principal legally appoints another entity the agent to act on its behalf by providing a service or performing a particular task. Agency relationships exist as mutual agreements between individuals small firms and large organizations.

The agency relationship in corporate finance occurs. Agency Theory in Financial Management. When the shareholders hire a manager to run their company.

When the corporate hires an advertising agency to market their new products of service. When the board of directors oversee the CEO. The principal-agent relationship is an arrangement between two parties in which one party the principal legally appoints the other party the agent to act on its behalf.

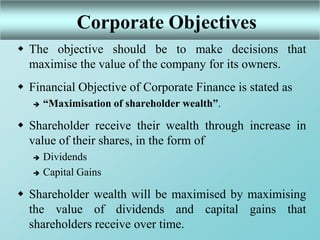

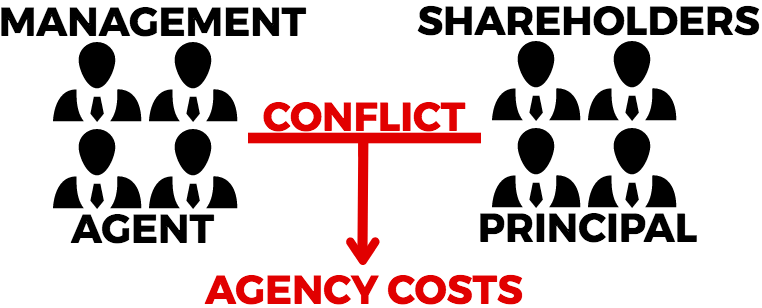

The principal-agent relationship plays a major role in agency costs. The theory revolves around the relationship between the two and the issues that may surface due to their different risk perspectives and business goals. Within corporate finance the agency problem is considered as the conflict of interest between the companys managers and its stockholders.

Shareholders may want to pursue one course of corporate action to maximize shareholder wealth and the managersincluding the board of directors the CEO and other high-level officialswant to pursue another course. In an agency relationship two parties exist the agent and principal whereby the former acts and takes decisions on behalf of the latter. The agency relationship in corporate finance refers to _____.

When the board of directors are elected to staggered terms 4. The agency problem can be defined as a conflict taking place when the agents entrusted with the responsibility of looking after the interests of the principals choose to use the power or authority for their benefits and in corporate finance. Agency relationship exists in the corporate form of organization because of the separation between the ownership and control.

An agency relationship occurs when a principal hires an agent to perform some duty. If you want to learn more about the agency relationship or you have any legal questions concerning this subject speaking with a lawyer is the best way to get answers. When the corporate hires an advertising agency to market their new productservice c.

An agency problem is a conflict of interest inherent in any relationship where one party is expected to act in anothers best interests. When the shareholders hire a manager to run their company b. The principal-agent problem occurs when the interests of a principal and agent come into conflict.

When the board of directors oversee the CEO 3. The agency relationship consists of the principal and the agent which is an arrangement where the principal legally elects an agent to represent them to act in the interest of the principal. This conflict occurs when personal interests are given a priority over the professional duties each party needs to fulfill.

Individuals who provide small amounts of capital and expert business advice to small firms in exchange for an ownership stake in the firm are referred to as. 5Headquarter office and the Branchsubsidiary. There are various types of agency relationship in finance exemplified as follows.

The duty of management or agency is. When the corporate hires an advertising agency to market their new products of service 2. When the shareholders hire a manager to run their company.

Why does agency issues arise in a company. Principal-agent problems occur when the interests of the principal and agent are not aligned. Agency costs mainly arise due to contracting costs and the divergence of control separation of ownership and control and the different objectives of the managers and other stakeholders.

In finance the most talked-about agency relationship exists. Agency relationships occur when one party the principal employs another party called the agent to. Agency costs occur when the shareholders and management diverge on their ideas of actions a company should take.

The conflict of interest between management and shareholders is called agency problem in finance. In finance agency relationship occurs between the shareholders and managers as shareholders hire managers to work on their behalf which create agency cost and conflicts as well. Definition of the Agency Problem.

The core of the conflict is that managers want higher compensation and. Agency theory is often described in terms of the relationships between the various interested parties in the firm. Agency relationship refers to a consensual relationship between two parties where one person or entity authorizes the other to act on his her or its behalf.

In corporate finance an agency problem usually refers to a. The agency relationship happens when a principal hires an agent for some activity on its behalf. Agency problems in finance occur when management damages the relationship with the stockholders.

When the board of directors are elected to staggered terms d. The agency relationship in corporate finance occurs when the shareholders hire a manager to run their company. Agency Problems by Sajna Fathima 2.

The agency theory examines the duties and conflicts that occur between parties who have an agency relationship. Agency problem arises due to the divergence or divorce of interest between the principal and the agent. The agency relationship in corporate finance occurs.

Agency Problem The Principal-Agent Relationship The Agent is the person that acts whereas the Principal is the person that receives the benefits from the actions. For example lets say Wilma contracts with Rustys Rawhide to buy 500. When the board of directors are elected to staggered terms.

Companies should seek to minimize.

:max_bytes(150000):strip_icc()/shutterstock_253136563-5bfc2b98c9e77c00519aa7a8.jpg)

Corporate Finance Concepts And Tools

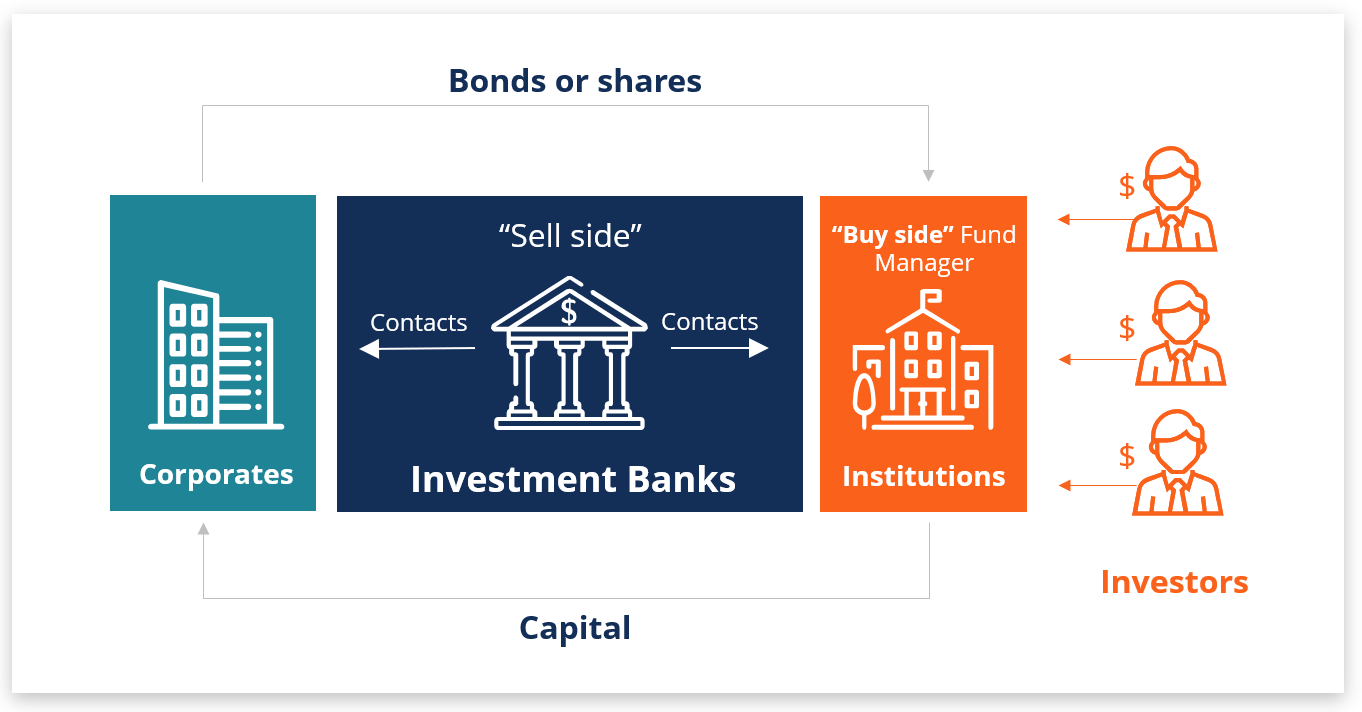

Investment Banking Overview Guide What You Need To Know

1 Introduction To Corporate Finance

/GettyImages-181133030-7f50eb712b0c49ba9c038f131fc189e4.jpg)

The Role Of Agency Theory In Corporate Governance

1 Introduction To Corporate Finance

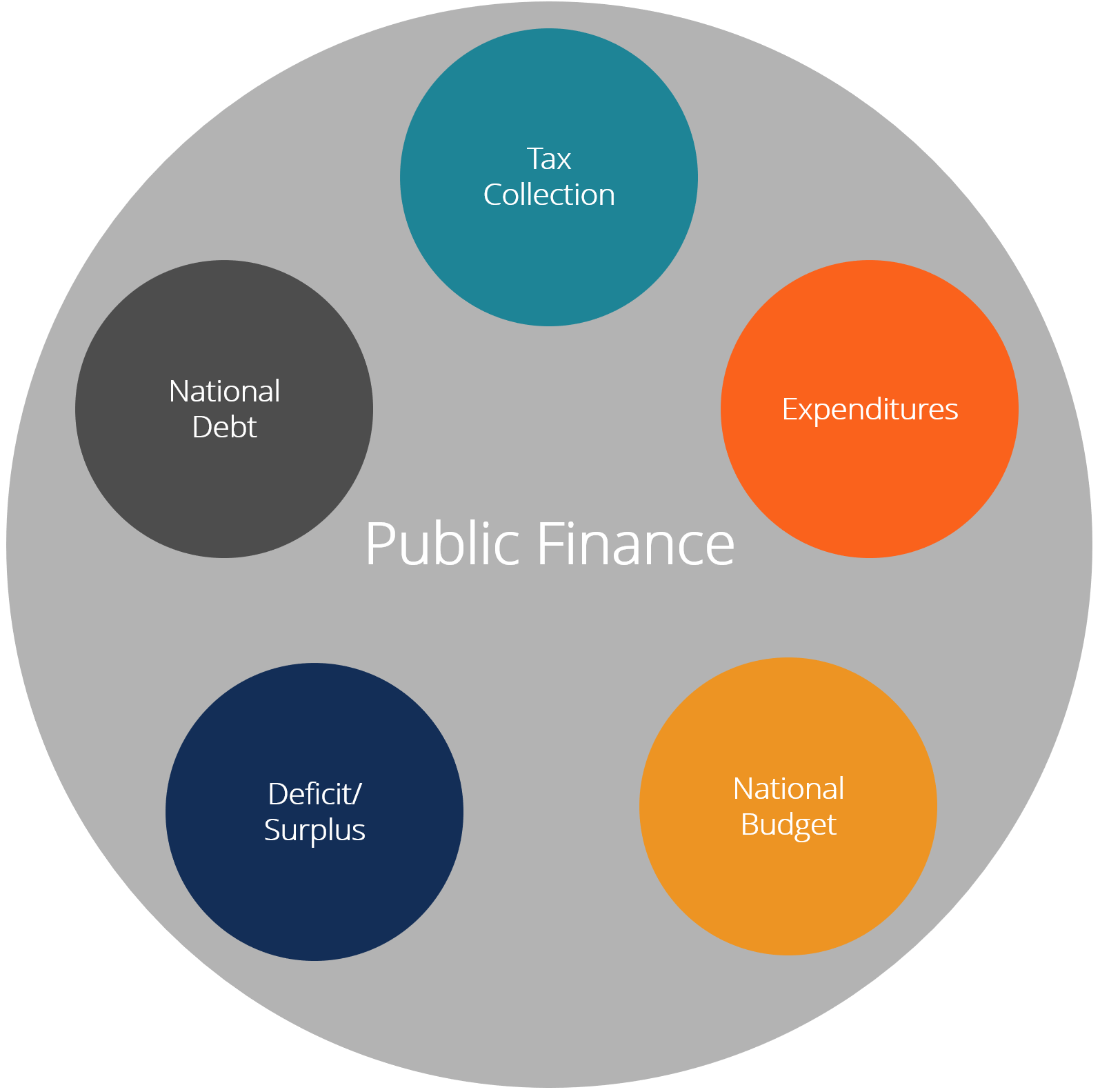

Public Finance Overview Example How Government Finance Works

1 Introduction To Corporate Finance

Corporate Identity Letter P Business Icons Vector Gas And Logistic Transport And Design Shopping And Repairing S Business Icon Corporate Identity Lettering

What Is The Agency Problem Valuation Master Class

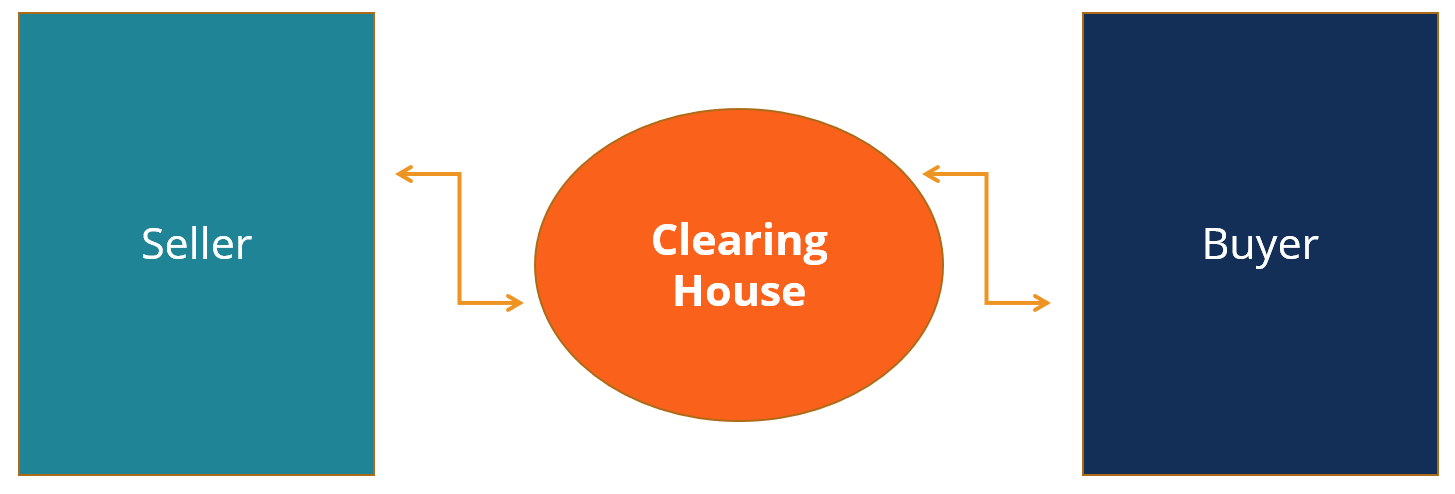

Clearing House Definition Functions And Importance

Principal Agent Problem Overview Examples And Solutions

:max_bytes(150000):strip_icc()/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

Depository Overview Functions Types Of Institutions

Investment Banking Overview Guide What You Need To Know

Fin 571 Corporate Finance Week 1 To 6 Oassignment Final Exams Exam Finance

Agency Costs Learn About Direct And Indirect Agency Costs

Agency Problem In Finance Overview Duties Examples What Is The Agency Problem Video Lesson Transcript Study Com